On Sept. 30, a new era will begin at Whidbey Island Bank and its holding company, Washington Banking Company.

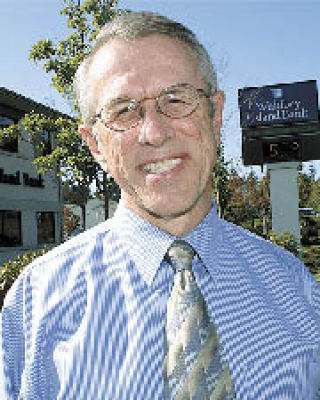

Michal Cann, the man who led the company over the last 15 years, will retire as president and chief executive officer of Washington Banking Company. At the same time, he will retire from his position on the board of directors for the bank and holding company.

Cann said it’s just a coincidence that he’s leaving so soon after the failure of the company’s planned merger with Frontier Financial, a deal that was essentially shut down by government regulators.

“I just had my 60th birthday,” he said. “My wife has been saying she would like me to be home more often.”

After all, the man has seven grandchildren to spoil. But also, he said it’s just a good time to make an exit.

“We have a really good team to run the company,” he said.

Last year, Jack Wagner took over Cann’s previous role as president and CEO of Whidbey Island Bank, while Cann remained at the helm of the holding company. With this retirement, Cann will give up all his responsibilities to Wagner, a Bellingham resident.

While Wagner will be grappling with running a bank during a difficult economy, Cann said he and his wife will be living large at their Oak Harbor home and spending quality time at their vacation home in Leavenworth.

Cann guided the bank, which is the last locally-owned bank on the island, through a time of tremendous growth. He became vice president of the bank in 1992 and was promoted to president and CEO the following year. During his tenure, the bank grew from five branches on Whidbey Island and one on Camano Island and $70 million in assets to 19 branches across five counties and nearly $900 million in assets.

“Over his career, Mike has distinguished himself as one of the top bankers in the region,” said Tony Pickering, Chairman of the Board. “He’s been responsible for building this company into one of the northwest’s premier regional community banks.”

Cann admits that it’s currently a very tough time in banking, with the continuing fallout from the mortgage crisis.

According to the bank’s Web site, Washington Banking Company stock lost more than half its value since the beginning of the year, from $15.85 on Jan. 2 to $7.15 Monday. Company officials previously said the stock had been trading artificially high because of the pending merger, but now it’s at a more accurate place. Ten years ago, the value was at $5.69.

In fact, Cann said he leaves the company in a healthy financial place.

“We had a really good first quarter,” he said. “We’re well positioned to move forward.”

The bank isn’t currently exploring other mergers, he said, but is “recommitting itself to being independent.”

A life-long banker, Cann came to Whidbey from Valley Bank in Skagit County, where he served as president and CEO. Cann is a native of Libby, Montana.