New, stringent enforcement of rules governing heavy trucks’ federal tax obligations is causing consternation among some Island County staffers and companies, one county official said.

The IRS imposes an annual “heavy highway vehicle use tax” on vehicles weighing 55,000 pounds or more, with some exceptions. Part of the money collected comes back to the states as large sums for highway maintenance.

Once the truck’s owner pays the taxes to the IRS, that agency furnishes proof of payment in the form of a stamped IRS form.

The stamps may be applied by hand, or they may be digital watermarks if a return has been filed electronically.

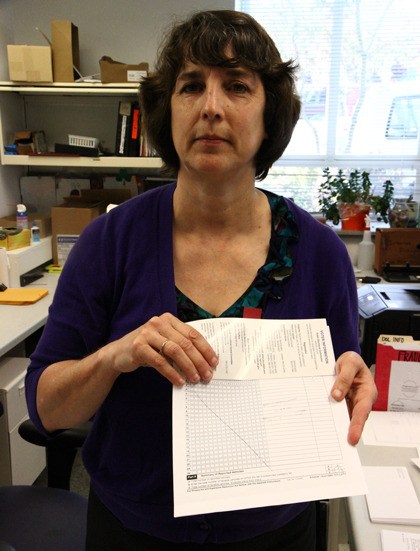

The stamps are the root of the problem, said Beth Kelly, Island County’s head of recording and licensing.

Heavy-truck owners must show the stamped form to renew a truck’s annual license tabs. In years past, if the stamp was partial, illegible or otherwise imperfect, licensing staffers like Kelly and her crew could let them slide.

But several weeks ago, the state Department of Licensing, or DOL, told its county-level agents, including Kelly, that the stamps must be completely legible — down to the letter — or the truck would be deemed not to have paid the tax.

That would mean the agent couldn’t issue the tabs, so the truck cannot operate lawfully.

One garbage truck belonging to Island Disposal has already been immobilized because of an illegible stamp, Kelly said.

Trucks from Engle Family Farms, Baily Dirtworks and Hanson’s Building Supply may be kept off the road because their owners were stuck with illegible stamps.

In fact, Kelly said, a state DOL representative came to Kelly’s office recently and rejected as illegible every one of the nine IRS forms she had on file from area companies.

“This could become a big deal if it keeps heavy trucks off the roads,” she said. “Garbage won’t get dumped, gravel won’t get hauled, construction will halt.”

Forms with illegible stamps must be reissued by the IRS, and it’s up to the trucks’ owners to obtain those new, clearly stamped forms, she said.

“The customers have already complied with the law, and they are very angry that they have to go back to the IRS and get new stamped forms,” Kelly said. “They are saying they just want to run their businesses.”

“And we end up looking like the bad guys.”

DOL since early 2015 has been training its agents, including county auditors’ staffs, to help crack down on fraud, acknowledged Dave Bennett, a DOL spokesperson.

“Fraud is very costly and also dangerous — it puts everyone on the road at risk,” he said. This year DOL has begun sending staffers to give agents face-to-face training.

“The area of stamps on heavy-vehicle tax receipts is one area where we know there is fraud,” he said.

IRS spokesperson David Tucker said concerns over the legibility of the stamp are a matter of state enforcement.

“The stamping hasn’t changed from the IRS side of the house,” he said. “It’s the DOL that determines enforcement, as each state does.”