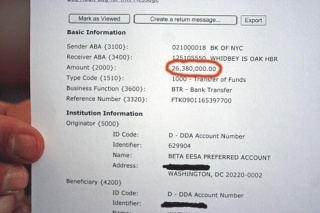

The U.S. Treasury Department wired $26.38 million to Whidbey Island Bank early Friday morning.

The cash infusion makes Washington Banking Company, the holding company for the Oak Harbor-based bank, the latest in a series of healthy banking companies to participate in the federal government’s Capital Purchase Program, which is part of the controversial $700 billion Troubled Asset Relief Program.

“It’s an extremely prudent move in these tough economic times,” Jack Wagner, company president and CEO, told the Whidbey News-Times. He added that the action will keep the bank well capitalized in case the economy continues to deteriorate for years to come.

“We are one of the best run and most profitable banks in the state. Now we will be one of the safest out there for depositors and investors,” he added.

Under the program, the federal government purchased $26.38 million in preferred shares and warrants.

Rick Shields, chief financial officer of the bank, said the preferred share is “sort of a cross between common stock and debt.” The bank will pay 5 percent a year in dividends on the preferred shares for five years, after which the rate will increase to 9 percent if the shares aren’t redeemed.

The federal government also received 492,000 warrants, which Shields describes as “the right to buy a share of common stock” at the set price of $8.04 a share. The price is an average of the company’s stock price over a certain period.

The Treasury Department started the program to encourage financial institutions to build capital to increase the flow of financing to businesses and consumers and to support the U.S. economy.

Whidbey Island Bank officials announced in December that they received preliminary approval of an application for the Treasury Department to invest $26.38 million in Washington Banking’s preferred stock and common stock warrants.

Tuesday, Washington Bank Company stockholders cleared the final hurdle for the deal to go through. They approved a measure to amend the company’s articles of incorporation to increase the number of preferred stock.

Wagner said it makes sense for stockholders to be in favor of the action.

“With all this extra capital, the safety for their investment should certainly be improved,” he said.

But the money won’t affect the bank’s loan practices. He said the bank has maintained the same practices throughout the economic downturn, despite the stories of credit tightening.

“No good loans that have been submitted to our bank have been turned down,” he said.

The money from the federal government will be combined with the bank’s assets. Wagner said there’s really no way to keep it separate in order to track how the treasury funds were used, as some lawmakers have suggested.

Whidbey Island Bank and the parent company are both “well capitalized” under regulatory guidelines.

The company will report fourth quarter earnings next week. According to the third quarter statement, “total shareholders’ equity improved to $79 million at September 30, 2008, compared with $78 million at June 30, 2008, and $72 million in the third quarter of 2007.”

In addition, the company reported total assets as of Sept. 30, 2008, at $912 million, which was up 5 percent over the year.

Whidbey Island Bank is the only bank that still has a headquarters on the island. A group of Whidbey Island business people started it in Coupeville in the early 1960s.

Today, the bank is one of the largest employers on Whidbey Island. It has 19 branches, with nearly 300 employees, in Island, San Juan, Skagit, Snohomish and Whatcom counties. A new branch was opened in Smokey Point last week.

“We’re doing fine in this market compared to our peers,” Wagner said.